Table of Content

Did you know that your down payment amount can have an impact on your mortgage rate? That's because mortgage rates are generally tiered, and typically lower rates are available for those with a down payment of 20% or more. If possible, check with your lender to see if increasing your down payment will lower your mortgage interest rate. If you are more concerned about just getting on the property ladder, then you might want an interest only mortgage. Generally, interest only mortgages have smaller monthly payments.

This link takes you to an external website or app, which may have different privacy and security policies than U.S. We don't own or control the products, services or content found there. Only four in ten Americans could afford a home under such conditions.

Mortgage Calculator For 300000

During the Great Depression, one-fourth of homeowners lost their homes. We've been comparing and recommending mortgage deals for many years so you can trust you're in good hands. If you want to explore your mortgage options, it is a good idea to speak to anindependent mortgage brokerwho will be able to offer impartial advice.

While we are independent, the offers that appear on this site are from companies from which finder.com receives compensation. We may receive compensation from our partners for placement of their products or services. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products.

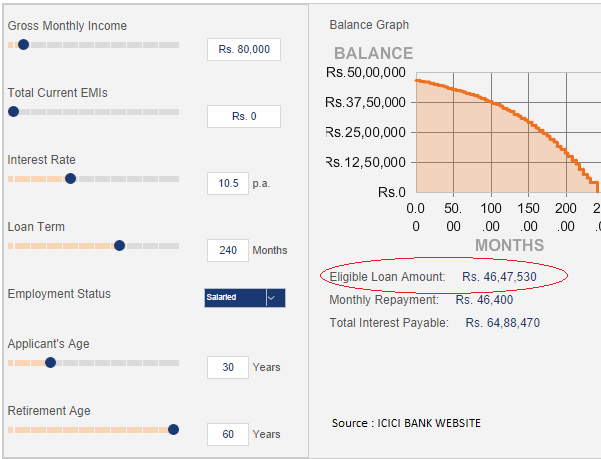

$300,000 House — Mortgage Rates

Additionally, rounding needs to be done to display payment amounts so that can be lead to results that appear slightly different but are still accurate. An amortization calculator determines payment information for any type of loan although it is most commonly used for mortgages. It requires a starting amount , an annual interest rate and a length in years or months .

There may be an escrow account involved to cover the cost of property taxes and insurance. The buyer cannot be considered the full owner of the mortgaged property until the last monthly payment is made. In the U.S., the most common mortgage loan is the conventional 30-year fixed-interest loan, which represents 70% to 90% of all mortgages.

Mortgage Calculator Components

The annual cost typically ranges from 0.3% to 1.9% of the loan amount. With VA loans, your monthly mortgage payment and recurring monthly debt combined should not exceed 41%. So if you make $3,000 a month ($36,000 a year), you can afford a house with monthly payments around $1,230 ($3,000 x 0.41).

Mortgages are how most people are able to own homes in the U.S. An FHA loan is a government-backed conforming loan insured by the Federal Housing Administration. FHA loans have lower credit and down payment requirements for qualified homebuyers. For instance, the minimum required down payment for an FHA loan is only 3.5% of the purchase price.

However, there are some lenders that prohibit overpayments, and they will levy large early repayment charges if overpayments are made. Therefore, before you make any overpayment on your mortgage you should always check with your mortgage provider. One of the main factors when deciding whether to take out a mortgage is the size of the mortgage repayments. Finder.com is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions.

Zillow's affordability calculator allows you to customize your payment details, while also providing helpful suggestions in each field to get you started. You can calculate affordability based on your annual income, monthly debts and down payment, or based on your estimated monthly payments and down payment amount. Make extra payments—This is simply an extra payment over and above the monthly payment.

The annual real estate tax in the U.S. varies by location; on average, Americans pay about 1.1% of their property's value as property tax each year. Calculate an amortization schedule for a $300,000 mortgage loan. Enter your loan details into the calculator and the results will show below.

The amount that a lender charges a borrower for taking out a loan. Typically, the interest rate is expressed as an annual percentage of the loan balance. The borrower makes payments to the lender over a set period of time until the loan is paid in full. Our affordability calculator uses the current national average mortgage rate.

For example, paying off a mortgage with a 4% interest rate when a person could potentially make 10% or more by instead investing that money can be a significant opportunity cost. Loan term—the amount of time over which the loan must be repaid in full. Most fixed-rate mortgages are for 15, 20, or 30-year terms.

It assumes a fixed rate mortgage, rather than variable, balloon, or ARM. With a FHA loan, your debt-to-income limits are typically based on a 31/43 rule of affordability. This means your monthly payments should be no more than 31% of your pre-tax income, and your monthly debts should be less than 43% of your pre-tax income.

No comments:

Post a Comment